HSBC Bank Australia Limited - a bunch of fucking arseholes.

My Review of HSBC in Australia:

Firstly - to make this whole article easier to digest...

The first bit is me basically being insane - "This is a BAD place to be doing business with".

The second bit is about the management of HSBC being an outright pack of cunts, involved in laundering squillions of cocaine $$$$$ from Mexico via Australia, and back to the USA....

If you find my being off my dial with insane frustration to be a bit hard to chew, just scroll down to the ~~~~~~~~~~ separator, to get to the NASTY Corporate Crap.

OK now into my grizzle....

"HSBC - I want to find out why, payments into my account, as well as payements from my account take 2 days longer than other banks, and take 3 days to show up on my account - respectively.

Call the head office, ask to be put through to some one in Australia, who was born here and speaks english, and they put me through to a foreign call centre, with some twat who wants to ask me all these questions, so that he can put it in an email, to send to "them", so that they can call me back...... like 3 days later or never or something....

If they put the call through to the person I wanted to talk too, in the first place, it would cut out a great deal of time wasting and stupid bullshit.

But this is how the retards of the HSBC Australia operate."

Into business:

https://au.trustpilot.com/review/www.hsbc.co.uk

152 reviews. One out of five stars rating.

http://www.consumeraffairs.com/finance/hsbc.html

647 reviews. One out of five stars rating.

https://www.creditkarma.com/reviews/banking/single/id/hsbc-bank3

91% of reviews. One out of five stars rating.

http://www.mybanktracker.com/HSBC-Bank/Reviews

62 reviews. Two out of five stars rating.

http://www.customerservicescoreboard.com/HSBC

510 negative reviews. 7 positive reviews

Want to have these idiots fuck something of yours up, and then try to get it resolved, eventually, by someone who was born in Australia, who speaks fucking English and who has the ability to chase up issues AND get them fixed?

When the front line of the corporate head office - refuse to do put your call through to anyone in Australia, and put you through to the fucking foreign call centres AGAIN...

I mean there are loads of people from the UK who thought the HSBC bank had the sun shining out their arses, in the UK - where the bank and the apparently stern banking regulations are....

Banked with them for 20 years etc... Come to Australia - only to find that the Australian branch is such a bunch of useless fucking arseholes, that they close their accounts... and leave really bad reviews in the process.

See the OTHER reviews on the Product Review website (link supplied)

I get my pay into my account - the it vanishes into the HSBC system and the best they can do is tell me to contact the payer, because they are just plain too fucking stupid to resolve the problem THEY created, from within their own system, and there is no one there who can or will do anything about it...

The payer says the transfer took place and there has been no bounce back...

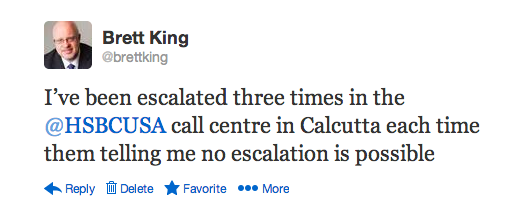

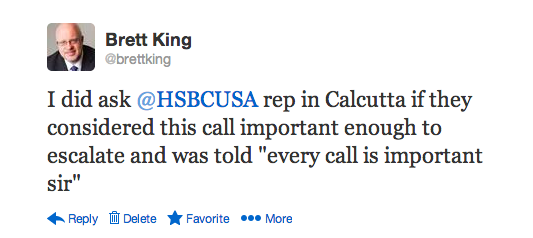

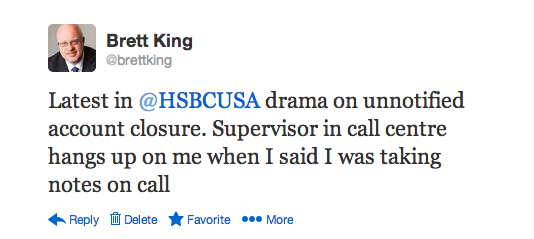

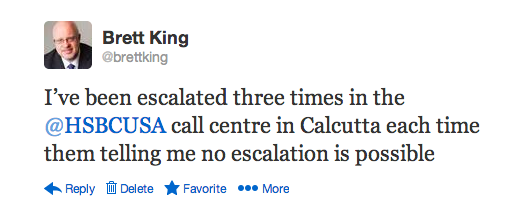

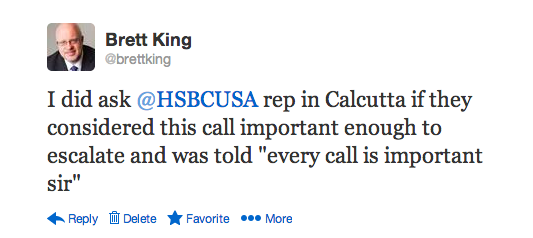

The HSBC foreign call centres are filled with fuckwits - 99 questions, no resolution, no transferring / escalating the call / transferring it back to Australia - to some fucking arsehole manager who can get the issue fixed - not a fucking chance.

None of the fucking arseholes in the Australian Head Office - no one to be put through too... Only bouncing people back to the foreign call centre fuckwits, who tell me to call the payer...

Fuck them.... Fuck the lot of them.

75 out of 94 reviews - Of all the "Terrible Service" reviews - people pretty much are almost universally closing their accounts - even long term account holders from the UK....

http://www.productreview.com.au/r/hsbc/771593.html

Probably one of the worst banks ever.

1 out of 5, reviewed on Jul 28, 2015, viewed 97 times

OK - I will try to illustrate the point rather than be factually correct - because it's such a nightmare, and takes ages to retell.

Opening an account with them? Forget it >:(

It goes like this, ring them vs online, because there are two completely different ways to open the same account.

Then there is a nightmare mix of phone them / go online - start to open up the account, then call them back, be sent an SMS, go back online, enter the details, check emails, follow link, go back online, then phone them, and then receive SMS, and then go back online to enter the details, and then phone them to get more numbers, and then..

Mixed in with this are numerous call drop outs and frequent "enter code" to a computer phone prompter.. Ugghhhhhh.

Included is sending out assorted parts of this fiasco by post. I have never seen anything, more convoluted, fragmented, spread all over the communications spectrum (phone / SMS / Email / online / post) just to get an account/s started.

This results in a small encyclopedia of numbers and codes.

You have your user name.

You have your new password.

You have your new secondary password.

You have a new security question.

You have a new secondary security question.

You have a 10 digit personal banking number.

You have a 6 digit access code.

You have a 12 digit account number.

You have the BSB.

And then you have your PIN.

Then if you ask for it, they send out a linked code generator for online banking. I think the beefed up security is much better than the typical lax Australian banks account security but it's so badly implemented.

I then get some money transferred into my account and I want to start banking, I remember my PIN number, but it does not work. AND after three tries, rather than risk losing my card. I ring them to get them to send me out a new pin number by SMS. But instead of sending out a new PIN by SMS in the next 5 or 10 minutes, they send it out 48 hours later.

(Think say Starting Tuesday Morning.... SMS arrives late Thursday afternoon.)

This is in the form of a message, that you have to reply to, with some code number, which gets replied to with the sending of the actual PIN.

This is where it gets really crappy - on that I cottoned on to the fact that they get you to sign up to your account and to create a SIX digit pin number, BUT Australian ATM's and EFTPOS machines are all geared up to only take and use FOUR digit pin numbers.

So their incompetence shines through, and leaves me cashless for like 3 days.

And they don't "get it" - that this is not OK.

So I try to complain and bring them out of the celestial crapper, and into the 22nd century. 15 calls to people with Malaysian and Filipino accents, who say they are all in a Sydney, Australia call centre who will pass the suggestion on, but won't fix the problem or escalate the call, or put me through to someone who isn't Asian and can speak fluent english and will send out an SMS with a new PIN in the next 5 minutes.

Then in moving on from the customer call centre to the head office in Australia - some people speak English, others don't, the calls keep on getting directed through to "peoples answering machines" - instead of a REAL person - who never bother to call you back.

In spite of the one explanation many times, after having verified myself, about how an SMS with a new PIN should be sent upon request, and not 48 hours later - well purchase records from autotellers / EFTPOS sales / phone and internet banking etc., all transmitting immediately - well so should the supplying of new PIN number, to a verified inquiry.

No one can fix it, no one knows who can, no one will find out, no one will try to find out, and as far as jumping from the call centre to the Australian head office - go to the start of the sentence and include answering machines (5 so far) and no calls back....

The conversations typically go like this, I state the problem, I want a new PIN to be sent out in 10 minutes, instead of 48 hours, and I want the policy changed, and I want to speak to the person who can change it. The important thing is to demand an answer "Can you do this for me?" otherwise they will drag you into all this personal information identification thing, then they will put you on hold while they read your file - and then they will tell you it can't be done. Needless to say I am no fan of foreign call centres - especially ones run by banks.

There once was a movie called "Eraser Head" - nothing particularly evil / bad / frightening - it was really tame as far as movies go, and it would be hard to find a more "non eventful" movie - but it was one of the most disturbing movies I have ever seen - because it was like being in a never ending living nightmare - and other reviewers said the same thing.. Watch it once and go for a weeks rest and recreation in a nice psych hospital. This is what dealing with the HSBC is like. Insane service and grossly incompetent management.

The grande finale, is that the management of the HSBC - in Sydney Australia, the people who don't want to talk to you or return your calls or fix up the problems they have created, are so interested in you and your opinions about their service, that they give your personal information to AC Neilsen, so that they can email you to participate in one of their surveys. Cough, Cough - don't think so.

On one hand, I want to keep my accounts - because they are like a prize for legless people climbing Mt Everest, but I want to ditch them ASAP and I intend too because the service is so bad.

As a follow up:

Money was deposited in my account overnight. Go to buy pressure cleaner - purchase declined 2 x. Ring the HSBC bank... - foreign call centre - the payment is not in there. Ring the pay office - payment was made.

Ring back the bank - foreign call centre - Can't find where the payment went - within the HSBC system, and won't find where the payment went - within the HSBC system. Told to ring the payer, to ask them about it... instead of transferring the call to someone who can find out where my money went - within the HSBC bank.

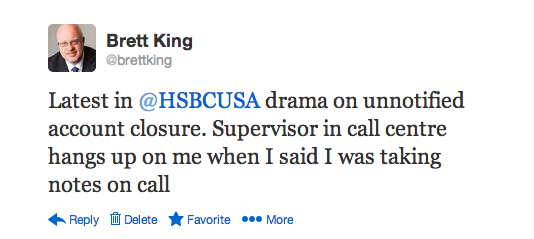

Call the head office - speak to "Aussie chick" - ask to speak to someone born in Australia, working in Australia, who can find out what "they" have done with my missing money - get hung up on.... Ring back - pay out on them.....

Their customer service wins the anti-christ popularity contest... I mean it's THAT bad.

Just because people work in foreign call centres - doesn't mean they are bad or incompetent... but when it comes to getting important things DONE - this bank and it's incompetent management, and their policies and procedures - where no one knows who does what even in the next cubicle - totally sucks. But they do excel at wasting your time and running you around in circles while being super busy doing nothing about anything. So 2 hours of my time have been wasted trying to find out what they have done, with my money, within their system....

The money is still NOT in my account, and NONE of the people in the HSBC - starting with the Australian Head Office - are of any help what so ever.

Forget about jumping ship - avoiding signing up with them in the first place. It's just easier that way.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

I want to speak to someone from AUSTRALIA...... You fucking ARSEHOLES!!!

But they are so fucking dense...

Dealing with them is like being at the bottom of a 1000 foot deep mine, with 999 feet of dirt on top...

Fucking retards the lot of them.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Anyway... I kicked up a huge stink...

The thin veneer of social pretence is dropped and the knuckle dusters are on:

This issue previously raised:

I SHOULD have money in my account, I go to buy something, it's declined twice, I ring the HSBC bank, they say you only have crumbs in your account - the full pay is not there.

I contact the paymaster, they say the payment went in, and there was no bounce back.

So the digital cash is LOST within the HSBC banking system.

The fucking retards working there, can't / won't / don't know how / won't transfer the call to someone who can...... And in trying to get out of the foreign call centre merry go round, the fucking ARSEHOLES at the Australian Corporate HEAD OFFICE reception - when I explain the situation and that I want to talk to a manager, in the corporate head office, who was born in Australia, who speaks english, who can fix up the problem they created for me - these fucking bitches bounce the call back into the foreign call centres....

Yeah fucking right on....

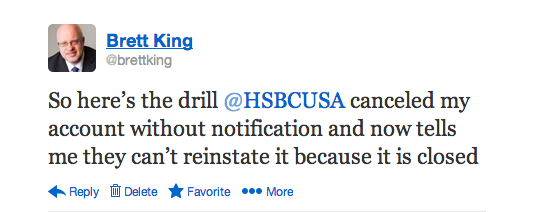

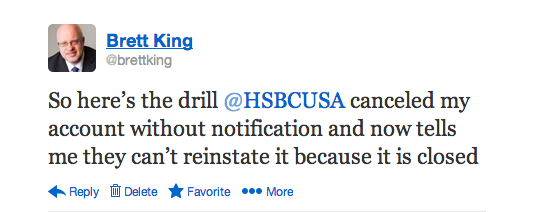

So I kicked up a wave of discontent - via social media, through their english speaking offices in the USA and the UK and Australia ..... because I am totally adverse to bullshit, incompetence, being given the run around, and "on the payroll" bludgers who just don't give a fuck anyway.

And in a slightly round about way, this response came by email - after multiple channels were engaged to contact them.....

The email goes like this:

Dear Fuck Face,

Firstly, please allow me to acknowledge the inconvenience you have

incurred. HSBC is committed to providing outstanding customer service at

all times, so your experience and resultant feedback will guide us in

identifying opportunities for review and improvement.

Fuck Face, I can confirm that your feedback has been provided to the

relevant Management area for their review and consideration.

Moreover, I would very much like to help you, however due to the

specific nature of your enquiry I can only assist you after confirming

your identity. An email sent from your personal email address or

submitted using the "Contact Us" option of our public website does not

meet our identification, security and privacy requirements.

So that we can service your enquiry, please call us on the phone number

below (available 24 hours) in order for us to adequately identify you.

This will either entail us asking you some verbal identification

questions or involve verification of your identity with the use of your

6 digit Phone Banking Access Code. We will then be able to immediately

assist you with your query over the telephone.

We look forward to hearing from you soon, in the meantime I wish you a

wonderful week ahead.

If you would like more information, please reply to this email or call

HSBC's Customer Service Centre 24 hours per day, seven days per week on

1300 308 008 or on +61 2 9005 8187 if calling from overseas.

Kind regards,

Kuljeet Singh

Customer Service Consultant

Direct Service Centre

HSBC Bank Australia Ltd

ABN 48 006 434 162 AFSL 232595

580 George Street, Sydney NSW 2000

www.hsbc.com.au

First thought.

What? You lazy cunt - you could not call me back on my own phone number? And what about the "managers" in the relevant dept - that you refer too? Why are they NOT on the phone to me? Lazy fucking arseholes.

And the ISSUE is named - in that information - you fuck holes have lost my money in your system - so go chase it up... Was it done? No? Why not? Because these retarded fucking arseholes want me to hop on their "shit for brains" merry go round with them ONE more fucking time, because ALL of them are too fucking stupid, and too fucking lazy to just go and look at the issue and FIX IT.

"Oh we can't fix it until you ring us up (for the 11th time?) and identify yourself (for the 11th time) and we will do fuck all about it again - for the 11th time.

And that phone number, only gets me Malay Mandi, Bombay Bob or Philippino Phred. An Australian Call Centre? Yahhhh Curry in a Hurry it is.

And I have said, "I am tired of dealing with people in foreign call centres, who can hardly speak english, who don't know what to do, won't try to do what I want, won't/ can't transfer the call to some one who can, don't know who can / don't have the numbers of those who can / can't transfer the fucking call back to a fucking dead beat shit head manager in Australia, because they can't / are not able to transfer the call back to Australia...."

"A brain transplant? First we start by removing the brain......"

So what am I doing getting a fucking shit for brains reply - saying nothing other than stupid shit to avoid admitting he's done nothing, by telling me to call a phone number 1300 308 008 - that diverts to another foreign call centre, and he has a name Kuljeet Singh - which kind of what fucking IDIOTS the management and staff actually ARE.....

More never ending go around in circles bullshit.

No fucking call backs, no promised response from the "HSBC Australia Customer Care Team" - fucking NOTHING...

Just MORE fucking bullshit.

The Reply:

Wow - if your so shit hot, how come your NOT sending me an email / making a phone call - telling me, we have found the problem, placed the money into your account and offer $250 as a way of saying sorry for the inconvenience?

I mean you already HAVE all the information, so what is there to discuss?~~~~~~~~~~~~~~~~~~~~~~~~~

So digging a bit deeper on these arse fuckers - lots and lots of retarded shit comes up...

a) The management of the HSBC Bank in Australia has been nailed for laundering billions in drug money....

Google: HSBC drug money laundering

So the management ARE a bunch of cunts who should be shot at point blank range for profiteering from this shit. Just drag them into the streets and lynch them.

https://en.wikipedia.org/wiki/Mexican_Drug_War

Google: Images: mexico drug murders

b) The management of the HSBC globally is into helping "rich people" conceal their wealth......

c) The management of the HSBC - amongst other banks, is into fiddling the global exchange rates to rig the payments in their favour....

(The LIDOR scandle - look it up)

d) The management of the HSBC is into funding deforestation - like the last remaining bits of it all.... by loaning the criminal loggers the money to do so...

e) The Management of the HSBC in the UK is into pressuring newspapers - who they pay lots of money too for advertising etc., to "go easy on them."

f) The CEO of the HSBC in the UK is a lying shifty arsehole - see his response in the logging article.

I shall load up with a few articles and links to them:

A technical brief:

http://www.compliance.org.au/news/view/1454

HSBC scandal: bank accused of wilful compliance failures in money laundering allegations

Monday 30 July 2012

A 335 page Senate report accused the bank of ignoring warnings and breaching safeguards that should have stopped the laundering of money from Mexico, Iran and Syria. The bank failed to monitor 38 trillion pounds or 57 trillion Australian dollars moving across borders from high-risk countries.

Evidence in the report shows that HSBC staff sought to get around sanctions that prevent American firms doing business with Iran. HSBC affiliates used a method called “stripping” to delete references to Iran from records of transactions. From 2001 to 2007, HSBC affiliates sent almost 25,000 transactions involving Iran worth over $19 billion through US accounts, while concealing any link with Iran in 85 per cent of the transactions.

According to the report, the bank’s compliance division “allowed the HSBC affiliates to continue to engage in these practices, which even some within the bank viewed as deceptive, for more than five years.”

Many of HSBC’s breaches relate to its use of so-called bearer share accounts, in which ownership of shares and the income they incur can be passed from person to person in secrecy.

Senator Carl Levin described a “pervasively polluted” culture within the bank.

The breaches occurred despite increasing legislative protections against money laundering implemented worldwide through the efforts of the Financial Action Task Force (FATF), formed in 1989 by the G7 in response to growing concerns about money laundering and terrorism financing. Countries involved in the allegations are FATF member states.

HSBC’s operations in Hong Kong have been implicated in the scandal. In 2009, HSBC Bank USA was said to have authorised its Hong Kong branch to open an account for Al Rajhi Bank, an organisation found to have ties to Al-Qaeda. The Singapore and Hong Kong branches also turned a blind eye to monies funnelled into accounts traced to Musa Aman for financing timber corruption in Malaysia and Borneo, as identified in the Malaysian Anti-Corruption Commission Report.

These developments will no doubt be of interest to Hong Kong regulators in light of the Hong Kong Monetary Authority’s closer attention to anti-money laundering and counter-terrorist financing measures.

http://www.theaustralian.com.au/business/financial-services/hsbcs-local-arm-under-scrutiny-by-us-amid-money-laundering-probe/story-fn91wd6x-1227474809777

HSBC’s local arm (Australia) under scrutiny by US amid money-laundering probe

HSBC in Australia has been drawn into a worldwide money-laundering probe forced upon the bank by US authorities after the global lender was found to have been laundering billions of dollars in cash from Latin American drug cartels and violating economic sanctions against pariah states.

The Weekend Australian can reveal that the Sydney headquarters of HSBC has been subject to ongoing visits by a US government-sanctioned monitoring team since June, as part of an agreement that the bank struck with US authorities to avoid criminal prosecution.

In 2013, HSBC in the US was forced to pay $US1.9 billion in fines and forfeiture after it was found to have violated numerous US anti-money laundering laws relating to laundering cash from drug cartels and sanctioned states.

Under a five-year deferred prosecution agreement (DPA), the bank escaped criminal prosecution by allowing a Department of Justice-sanctioned monitor the right to audit the bank’s staff and systems to ensure adherence to US anti-money laundering laws and a sanctions compliance program.

The independent monitoring team has the power to refer findings through the US Department of Justice to other US federal agencies such as the Federal Bureau of Investigation, the Internal Revenue Service and the Securities Exchange Commission.

Staff at the bank have been subject to numerous interviews by the monitoring team, costing the bank millions of dollars in legal fees and placing increasing stress on staff who have been asked to have a lawyer present at all interviews.

Failure of HSBC in Australia to properly comply with the auditing process could result in the reinstatement of criminal sanctions in the US and threaten the bank’s ability to trade in US dollars. Investigators can request information from central banks and regulators in the host country.

HSBC is one of the biggest international banks operating in Australia, with a lending book of $14.5 billion. However, its substantial scale in Asia means that it plays a key role in trade financing and offshore investment.

Under the agreement reached between the DoJ and HSBC in a New York court in 2013, HSBC has agreed to “continue to cooperate fully with the (government) in any and all investigations”.

The agreement further requires HSBC to make witnesses, information and documents available “concerning any and all investigation(s),” and provide “information, materials, documents, databases, or transaction data ... wherever located, should the government request it in connection with the investigation or prosecution of any current or former officers, directors, employees, agents or consultants,” according to court documents.

The investigative team is led by independent compliance monitor Michael Cherkasky, whose large team is understood to have been conducting an intense audit of HSBC’s Australian operations.

Mr Cherkasky specialises in improving the anti-money laundering programs of large financial institutions and has also served as an independent monitor to the Los Angeles Police Department.

A spokesman for HSBC in Australia declined to comment on the monitoring team’s activities, referring The Weekend Australian to the bank’s latest interim report’s statements on the activities of the monitor worldwide issued on August 3.

“We are working to implement the agreed recommendations flowing from the monitor’s 2013 and 2014 reviews. We recognise we are only halfway through our five-year Deferred Prosecution Agreement (‘US DPA’) and look forward to maintaining a strong, collaborative relationship with the monitor and his team.” A spokesman for the SEC declined to comment on its role in the monitoring, while The Weekend Australian understands that no FBI agents are present in Australia as part of the monitoring team.

HSBC was charged with violating the Trading With Enemy Act and International Emergency Economic Powers Act as well as failing to maintain an effective money laundering program.

According to the DoJ, HSBC failed to monitor $US670bn in wire transfers and $US9.4bn in cash transactions from its Mexico bank operations.

The US government found that HSBC’s USA lack of controls between 2006 and 2010 allowed Mexican and Columbian drug cartels to launder $US881m in drug trafficking proceeds from Mexican accounts to the US.

Between 2000 and 2006 the United States arm of HSBC was also found to have “knowingly and wilfully” process payments worth $US660m “on behalf of banks and other entities located in Cuba, Iran, Libya, Sudan, and Myanmar in violation of US sanctions”.

According to court documents filed by the DoJ this year “the monitor believes that HSBC Group has made progress in developing an effective AML (anti-money laundering) and sanctions compliance program.”

However, the monitor still expressed serious concerns with HSBC’s culture and compliance technology.

“At present, the monitor believes HSBC Group has a substantial amount of work left to do to implement its written policies.

“In the monitors view, two of the greatest impediments to HSBC Group’s implementation of a sustainable compliance program are its corporate culture and its compliance technology.

http://www.theguardian.com/commentisfree/2015/feb/15/hsbc-has-form-mexico-laundered-drug-money

HSBC has form: remember Mexico and laundered drug money

For the bank to get off with hollow statements of apology is to treat us all with contempt

The discourse this weekend over HSBC is whether the bank and those its Swiss subsidiary aided to evade tax should be prosecuted, like any other citizen. Or whether there should be a repeat of what happened last time HSBC was in major trouble: the bank paid a fine equivalent to a pittance in its turnover; executives not only got off but were promoted to higher service; and the PR guff promised that all was now aright.

It is worth recalling exactly what HSBC was found to be – and admitted – doing on that last occasion, in 2012: laundering hundreds of millions of dollars for the world’s biggest crime syndicate, the Sinaloa narco cartel of recently arrested “Chapo” Guzman.

Mexico’s narco nightmare now counts 100,000 dead and some 20,000 missing; there is no overstating the misery of its export – hard drugs – around the world. Yet only one stepping stone connects HSBC to this carnage and misery: the bank acted as the cartel’s financial services wing.

Much of the money swilling into HSBC from the cartel came through an apparently small exchange house, Casa de Cambio Puebla. The bank would later protest that it knew not whence the money came, but Puebla had been under investigation by Mexican and US Federal authorities for two years when HSBC was caught, for handling a staggering $376bn of suspect money for an American bank, Wachovia. Wachovia was punished with a “deferred prosecution” – a yellow card; none of its employees was arrested.

HSBC carried on, however, through the same exchange house and other channels: a bank it had bought in Mexico, another in California and, it emerged, even through its own branches. When HSBC was caught out, the head of the US Justice Department’s criminal division, Lanny Breuer, said that cartel operatives would arrive at the bank’s branches and “deposit hundreds of thousands of dollars in cash, in a single day, into a single account, using boxes designed to fit the precise dimensions of the teller windows”. HSBC asked no questions.

It was Breuer’s task to weigh up the case on the basis of a Senate report into HSBC’s shifting of Sinaloa money. It ended up at the Justice Department, where Breuer concluded that HSBC had been guilty of “stunning failures of oversight – and worse, that led the bank to permit narcotics traffickers and others to launder hundreds of millions of dollars through HSBC subsidiaries and to facilitate hundreds of millions more in transactions with sanctioned countries”, including money banked for terrorist organisations in the Middle East.

The bank was fined more than Wachovia, a record $1.9bn. But this was less than five weeks’ income for HSBC’s American subsidiary. Breuer deemed that HSBC should not be prosecuted in the way that a back-street dope-dealer would be; there would be a five-year “deferred prosecution”.

The bank announced that it would “partially defer bonus compensation for its most senior officials during the five-year period of the deferred prosecution agreement” – ergo they’d be renumerated with slightly less than usual. Ouch! But what HSBC did was not indictable.

And not just that: Paul Thurston, the man in charge of HSBC Mexico for some of the relevant period, was promoted to become head of global retail on a multi-million dollar salary. Stephen Green, the chief executive of the bank throughout its service to Chapo Guzman’s cartel, was appointed to the British government.

Green’s replacement as CEO, Stuart Gulliver, did what behemoth corporations always do in these situations: make a hollow statement to apologise for “past mistakes”. He said: “We accept responsibility for our past mistakes. We have said we are profoundly sorry for them.” He insisted HSBC was “a fundamentally different organisation” now. The bank said similar last week.

The reaction in Britain’s financial media was astonishing: to side with the bank against treacherous Mexicans manipulating its good name: “Mexico,” reported the Financial Times, “had become a compliance nightmare for HSBC.” The New York Times not only got the idea, but articulated it clearly:“Federal and state authorities have chosen not to indict HSBC, the London-based bank, on charges of vast and prolonged money laundering, for fear that criminal prosecution would topple the bank and, in the process, endanger the financial system.”

Referring to the Wachovia case, Robert Mazur, the US federal agent who infiltrated the BCCI bank, which was prosecuted for laundering money for Colombian drug lord Pablo Escobar, said something similar: “There were external circumstances that worked to Wachovia’s benefit, not least that the US banking system was on the edge of collapse.” Nevertheless, Mazur added cogently to this weekend’s deliberations: “The only thing that will get the message to the banks and start to solve the problem is the rattle of handcuffs in the boardroom.”

HSBC’s handling of Chapo Guzman’s blood money had no impact on the bank: the last letters you see on the ramp boarding a plane from London to Mexico City are HSBC, and they are the first on the arrivals ramp when you get there, near a hangar recently revealed to belong to the Sinaloa cartel. Now, for the bank to get off with a wag of the finger for its disdain for those of us who pay our taxes would be a scandalous affirmation that we no longer understand any difference between crime and legality. • Comments will be opened later today

http://www.rollingstone.com/politics/news/outrageous-hsbc-settlement-proves-the-drug-war-is-a-joke-20121213

Outrageous HSBC Settlement Proves the Drug War is a Joke

If you've ever been arrested on a drug charge, if you've ever spent even a day in jail for having a stem of marijuana in your pocket or "drug paraphernalia" in your gym bag, Assistant Attorney General and longtime Bill Clinton pal Lanny Breuer has a message for you: Bite me.

Breuer this week signed off on a settlement deal with the British banking giant HSBC that is the ultimate insult to every ordinary person who's ever had his life altered by a narcotics charge. Despite the fact that HSBC admitted to laundering billions of dollars for Colombian and Mexican drug cartels (among others) and violating a host of important banking laws (from the Bank Secrecy Act to the Trading With the Enemy Act), Breuer and his Justice Department elected not to pursue criminal prosecutions of the bank, opting instead for a "record" financial settlement of $1.9 billion, which as one analyst noted is about five weeks of income for the bank.

The banks' laundering transactions were so brazen that the NSA probably could have spotted them from space. Breuer admitted that drug dealers would sometimes come to HSBC's Mexican branches and "deposit hundreds of thousands of dollars in cash, in a single day, into a single account, using boxes designed to fit the precise dimensions of the teller windows."

This bears repeating: in order to more efficiently move as much illegal money as possible into the "legitimate" banking institution HSBC, drug dealers specifically designed boxes to fit through the bank's teller windows. Tony Montana's henchmen marching dufflebags of cash into the fictional "American City Bank" in Miami was actually more subtle than what the cartels were doing when they washed their cash through one of Britain's most storied financial institutions.

Though this was not stated explicitly, the government's rationale in not pursuing criminal prosecutions against the bank was apparently rooted in concerns that putting executives from a "systemically important institution" in jail for drug laundering would threaten the stability of the financial system. The New York Times put it this way:

And not only did they sell out to drug dealers, they sold out cheap. You'll hear bragging this week by the Obama administration that they wrested a record penalty from HSBC, but it's a joke. Some of the penalties involved will literally make you laugh out loud. This is from Breuer's announcement:

So you might ask, what's the appropriate financial penalty for a bank in HSBC's position? Exactly how much money should one extract from a firm that has been shamelessly profiting from business with criminals for years and years? Remember, we're talking about a company that has admitted to a smorgasbord of serious banking crimes. If you're the prosecutor, you've got this bank by the balls. So how much money should you take?

How about all of it? How about every last dollar the bank has made since it started its illegal activity? How about you dive into every bank account of every single executive involved in this mess and take every last bonus dollar they've ever earned? Then take their houses, their cars, the paintings they bought at Sotheby's auctions, the clothes in their closets, the loose change in the jars on their kitchen counters, every last freaking thing. Take it all and don't think twice. And then throw them in jail.

Sound harsh? It does, doesn't it? The only problem is, that's exactly what the government does just about every day to ordinary people involved in ordinary drug cases.

It'd be interesting, for instance, to ask the residents of Tenaha, Texas what they think about the HSBC settlement. That's the town where local police routinely pulled over (mostly black) motorists and, whenever they found cash, offered motorists a choice: They could either allow police to seize the money, or face drug and money laundering charges.

Or we could ask Anthony Smelley, the Indiana resident who won $50,000 in a car accident settlement and was carrying about $17K of that in cash in his car when he got pulled over. Cops searched his car and had drug dogs sniff around: The dogs alerted twice. No drugs were found, but police took the money anyway. Even after Smelley produced documentation proving where he got the money from, Putnam County officials tried to keep the money on the grounds that he could have used the cash to buy drugs in the future.

Seriously, that happened. It happens all the time, and even Lanny Breuer's own Justice Deparment gets into the act. In 2010 alone, U.S. Attorneys' offices deposited nearly $1.8 billion into government accounts as a result of forfeiture cases, most of them drug cases. You can see the Justice Department's own statistics right here: If you get pulled over in America with cash and the government even thinks it's drug money, that cash is going to be buying your local sheriff or police chief a new Ford Expedition tomorrow afternoon.

And that's just the icing on the cake. The real prize you get for interacting with a law enforcement officer, if you happen to be connected in any way with drugs, is a preposterous, outsized criminal penalty. Right here in New York, one out of every seven cases that ends up in court is a marijuana case.

Just the other day, while Breuer was announcing his slap on the wrist for the world's most prolific drug-launderers, I was in arraignment court in Brooklyn watching how they deal with actual people. A public defender explained the absurdity of drug arrests in this city. New York actually has fairly liberal laws about pot – police aren't supposed to bust you if you possess the drug in private. So how do police work around that to make 50,377 pot-related arrests in a single year, just in this city? Tthat was 2010; the 2009 number was 46,492.)

"What they do is, they stop you on the street and tell you to empty your pockets," the public defender explained. "Then the instant a pipe or a seed is out of the pocket – boom, it's 'public use.' And you get arrested."

People spend nights in jail, or worse. In New York, even if they let you off with a misdemeanor and time served, you have to pay $200 and have your DNA extracted – a process that you have to pay for (it costs 50 bucks). But even beyond that, you won't have search very far for stories of draconian, idiotic sentences for nonviolent drug crimes.

Just ask Cameron Douglas, the son of Michael Douglas, who got five years in jail for simple possession. His jailers kept him in solitary for 23 hours a day for 11 months and denied him visits with family and friends. Although your typical non-violent drug inmate isn't the white child of a celebrity, he's usually a minority user who gets far stiffer sentences than rich white kids would for committing the same crimes – we all remember the crack-versus-coke controversy in which federal and state sentencing guidelines left (predominantly minority) crack users serving sentences up to 100 times harsher than those meted out to the predominantly white users of powdered coke.

The institutional bias in the crack sentencing guidelines was a racist outrage, but this HSBC settlement blows even that away. By eschewing criminal prosecutions of major drug launderers on the grounds (the patently absurd grounds, incidentally) that their prosecution might imperil the world financial system, the government has now formalized the double standard.

They're now saying that if you're not an important cog in the global financial system, you can't get away with anything, not even simple possession. You will be jailed and whatever cash they find on you they'll seize on the spot, and convert into new cruisers or toys for your local SWAT team, which will be deployed to kick in the doors of houses where more such inessential economic cogs as you live. If you don't have a systemically important job, in other words, the government's position is that your assets may be used to finance your own political disenfranchisement.

On the other hand, if you are an important person, and you work for a big international bank, you won't be prosecuted even if you launder nine billion dollars. Even if you actively collude with the people at the very top of the international narcotics trade, your punishment will be far smaller than that of the person at the very bottom of the world drug pyramid. You will be treated with more deference and sympathy than a junkie passing out on a subway car in Manhattan (using two seats of a subway car is a common prosecutable offense in this city). An international drug trafficker is a criminal and usually a murderer; the drug addict walking the street is one of his victims. But thanks to Breuer, we're now in the business, officially, of jailing the victims and enabling the criminals.

This is the disgrace to end all disgraces. It doesn't even make any sense. There is no reason why the Justice Department couldn't have snatched up everybody at HSBC involved with the trafficking, prosecuted them criminally, and worked with banking regulators to make sure that the bank survived the transition to new management. As it is, HSBC has had to replace virtually all of its senior management. The guilty parties were apparently not so important to the stability of the world economy that they all had to be left at their desks.

So there is absolutely no reason they couldn't all face criminal penalties. That they are not being prosecuted is cowardice and pure corruption, nothing else. And by approving this settlement, Breuer removed the government's moral authority to prosecute anyone for any other drug offense. Not that most people didn't already know that the drug war is a joke, but this makes it official.

Breuer this week signed off on a settlement deal with the British banking giant HSBC that is the ultimate insult to every ordinary person who's ever had his life altered by a narcotics charge. Despite the fact that HSBC admitted to laundering billions of dollars for Colombian and Mexican drug cartels (among others) and violating a host of important banking laws (from the Bank Secrecy Act to the Trading With the Enemy Act), Breuer and his Justice Department elected not to pursue criminal prosecutions of the bank, opting instead for a "record" financial settlement of $1.9 billion, which as one analyst noted is about five weeks of income for the bank.

The banks' laundering transactions were so brazen that the NSA probably could have spotted them from space. Breuer admitted that drug dealers would sometimes come to HSBC's Mexican branches and "deposit hundreds of thousands of dollars in cash, in a single day, into a single account, using boxes designed to fit the precise dimensions of the teller windows."

This bears repeating: in order to more efficiently move as much illegal money as possible into the "legitimate" banking institution HSBC, drug dealers specifically designed boxes to fit through the bank's teller windows. Tony Montana's henchmen marching dufflebags of cash into the fictional "American City Bank" in Miami was actually more subtle than what the cartels were doing when they washed their cash through one of Britain's most storied financial institutions.

Though this was not stated explicitly, the government's rationale in not pursuing criminal prosecutions against the bank was apparently rooted in concerns that putting executives from a "systemically important institution" in jail for drug laundering would threaten the stability of the financial system. The New York Times put it this way:

Federal and state authorities have chosen not to indict HSBC, the London-based bank, on charges of vast and prolonged money laundering, for fear that criminal prosecution would topple the bank and, in the process, endanger the financial system.It doesn't take a genius to see that the reasoning here is beyond flawed. When you decide not to prosecute bankers for billion-dollar crimes connected to drug-dealing and terrorism (some of HSBC's Saudi and Bangladeshi clients had terrorist ties, according to a Senate investigation), it doesn't protect the banking system, it does exactly the opposite. It terrifies investors and depositors everywhere, leaving them with the clear impression that even the most "reputable" banks may in fact be captured institutions whose senior executives are in the employ of (this can't be repeated often enough) murderers and terrorists. Even more shocking, the Justice Department's response to learning about all of this was to do exactly the same thing that the HSBC executives did in the first place to get themselves in trouble – they took money to look the other way.

And not only did they sell out to drug dealers, they sold out cheap. You'll hear bragging this week by the Obama administration that they wrested a record penalty from HSBC, but it's a joke. Some of the penalties involved will literally make you laugh out loud. This is from Breuer's announcement:

As a result of the government's investigation, HSBC has . . . "clawed back" deferred compensation bonuses given to some of its most senior U.S. anti-money laundering and compliance officers, and agreed to partially defer bonus compensation for its most senior officials during the five-year period of the deferred prosecution agreement.Wow. So the executives who spent a decade laundering billions of dollars will have to partially defer their bonuses during the five-year deferred prosecution agreement? Are you fucking kidding me? That's the punishment? The government's negotiators couldn't hold firm on forcing HSBC officials to completely wait to receive their ill-gotten bonuses? They had to settle on making them "partially" wait? Every honest prosecutor in America has to be puking his guts out at such bargaining tactics. What was the Justice Department's opening offer – asking executives to restrict their Caribbean vacation time to nine weeks a year?

So you might ask, what's the appropriate financial penalty for a bank in HSBC's position? Exactly how much money should one extract from a firm that has been shamelessly profiting from business with criminals for years and years? Remember, we're talking about a company that has admitted to a smorgasbord of serious banking crimes. If you're the prosecutor, you've got this bank by the balls. So how much money should you take?

How about all of it? How about every last dollar the bank has made since it started its illegal activity? How about you dive into every bank account of every single executive involved in this mess and take every last bonus dollar they've ever earned? Then take their houses, their cars, the paintings they bought at Sotheby's auctions, the clothes in their closets, the loose change in the jars on their kitchen counters, every last freaking thing. Take it all and don't think twice. And then throw them in jail.

Sound harsh? It does, doesn't it? The only problem is, that's exactly what the government does just about every day to ordinary people involved in ordinary drug cases.

It'd be interesting, for instance, to ask the residents of Tenaha, Texas what they think about the HSBC settlement. That's the town where local police routinely pulled over (mostly black) motorists and, whenever they found cash, offered motorists a choice: They could either allow police to seize the money, or face drug and money laundering charges.

Or we could ask Anthony Smelley, the Indiana resident who won $50,000 in a car accident settlement and was carrying about $17K of that in cash in his car when he got pulled over. Cops searched his car and had drug dogs sniff around: The dogs alerted twice. No drugs were found, but police took the money anyway. Even after Smelley produced documentation proving where he got the money from, Putnam County officials tried to keep the money on the grounds that he could have used the cash to buy drugs in the future.

Seriously, that happened. It happens all the time, and even Lanny Breuer's own Justice Deparment gets into the act. In 2010 alone, U.S. Attorneys' offices deposited nearly $1.8 billion into government accounts as a result of forfeiture cases, most of them drug cases. You can see the Justice Department's own statistics right here: If you get pulled over in America with cash and the government even thinks it's drug money, that cash is going to be buying your local sheriff or police chief a new Ford Expedition tomorrow afternoon.

And that's just the icing on the cake. The real prize you get for interacting with a law enforcement officer, if you happen to be connected in any way with drugs, is a preposterous, outsized criminal penalty. Right here in New York, one out of every seven cases that ends up in court is a marijuana case.

Just the other day, while Breuer was announcing his slap on the wrist for the world's most prolific drug-launderers, I was in arraignment court in Brooklyn watching how they deal with actual people. A public defender explained the absurdity of drug arrests in this city. New York actually has fairly liberal laws about pot – police aren't supposed to bust you if you possess the drug in private. So how do police work around that to make 50,377 pot-related arrests in a single year, just in this city? Tthat was 2010; the 2009 number was 46,492.)

"What they do is, they stop you on the street and tell you to empty your pockets," the public defender explained. "Then the instant a pipe or a seed is out of the pocket – boom, it's 'public use.' And you get arrested."

People spend nights in jail, or worse. In New York, even if they let you off with a misdemeanor and time served, you have to pay $200 and have your DNA extracted – a process that you have to pay for (it costs 50 bucks). But even beyond that, you won't have search very far for stories of draconian, idiotic sentences for nonviolent drug crimes.

Just ask Cameron Douglas, the son of Michael Douglas, who got five years in jail for simple possession. His jailers kept him in solitary for 23 hours a day for 11 months and denied him visits with family and friends. Although your typical non-violent drug inmate isn't the white child of a celebrity, he's usually a minority user who gets far stiffer sentences than rich white kids would for committing the same crimes – we all remember the crack-versus-coke controversy in which federal and state sentencing guidelines left (predominantly minority) crack users serving sentences up to 100 times harsher than those meted out to the predominantly white users of powdered coke.

The institutional bias in the crack sentencing guidelines was a racist outrage, but this HSBC settlement blows even that away. By eschewing criminal prosecutions of major drug launderers on the grounds (the patently absurd grounds, incidentally) that their prosecution might imperil the world financial system, the government has now formalized the double standard.

They're now saying that if you're not an important cog in the global financial system, you can't get away with anything, not even simple possession. You will be jailed and whatever cash they find on you they'll seize on the spot, and convert into new cruisers or toys for your local SWAT team, which will be deployed to kick in the doors of houses where more such inessential economic cogs as you live. If you don't have a systemically important job, in other words, the government's position is that your assets may be used to finance your own political disenfranchisement.

On the other hand, if you are an important person, and you work for a big international bank, you won't be prosecuted even if you launder nine billion dollars. Even if you actively collude with the people at the very top of the international narcotics trade, your punishment will be far smaller than that of the person at the very bottom of the world drug pyramid. You will be treated with more deference and sympathy than a junkie passing out on a subway car in Manhattan (using two seats of a subway car is a common prosecutable offense in this city). An international drug trafficker is a criminal and usually a murderer; the drug addict walking the street is one of his victims. But thanks to Breuer, we're now in the business, officially, of jailing the victims and enabling the criminals.

This is the disgrace to end all disgraces. It doesn't even make any sense. There is no reason why the Justice Department couldn't have snatched up everybody at HSBC involved with the trafficking, prosecuted them criminally, and worked with banking regulators to make sure that the bank survived the transition to new management. As it is, HSBC has had to replace virtually all of its senior management. The guilty parties were apparently not so important to the stability of the world economy that they all had to be left at their desks.

So there is absolutely no reason they couldn't all face criminal penalties. That they are not being prosecuted is cowardice and pure corruption, nothing else. And by approving this settlement, Breuer removed the government's moral authority to prosecute anyone for any other drug offense. Not that most people didn't already know that the drug war is a joke, but this makes it official.

http://www.counterpunch.org/2015/08/14/mexicos-war-on-journalists/

August 14, 2015

Mexico’s War on Journalists

Earlier this summer, Ruben Espinosa fled Mexico’s Gulf coast state of Veracruz after receiving death threats. His work as a photojournalist there had made him an enemy of the state’s governor, who presides over one of the most dangerous places in the world to be a reporter.

On July 31, Espinosa was found beaten and shot dead in a Mexico City apartment.

Eight months ago, Nadia Vera, a student activist and cultural worker, looked boldly into a camera lens and told an interviewer that if anything happened to her, Veracruz governor Javier Duarte and his cabinet should be held responsible. She also fled Veracruz to the nation’s capital after suffering attacks.

On July 31, Nadia Vera was found sexually tortured and murdered, shot point-blank in the same apartment.

Three more women were assassinated in the normally tranquil, upper-middle class neighborhood that afternoon — an 18 year-old Mexican named Yesenia Quiroz, a Colombian identified only as “Nicole,” and a 40 year-old domestic worker named Alejandra. The press generally refers to the case as “the murder of Ruben Espinosa and four women,” relegating the women victims to anonymity even in death.

At a recent demonstration of journalists and human rights defenders, the sense of dread was palpable. As communicators in Mexico, we’re angry and intensely frustrated at how so many of our ranks have been killed, disappeared, displaced, or censored with no repercussions.

For many, including me, this crime especially hit home. For a long time, whenever I was asked if I was afraid to speak out critically in Mexico, I answered that fortunately Mexico City was relatively safe. Drug cartels and their allies in government only kept close tabs on reporters in more disputed areas.

The quintuple homicide in a quiet corner of the city shattered that myth — and with it what was left of our complacency. Several days before his murder, Espinosa told friends that a man had approached him to ask if he was the photographer who fled Veracruz. When he said yes, the man replied, “You should know that we’re here.”

Once considered a haven, Mexico City has become a hunting ground in a country where, too often, journalists end up reporting on the brutal assassinations of their colleagues — and wondering who will be next.

Targets

Ruben Espinosa had photographed social movements in the state of Veracruz for the past eight years, including journalists’ protests over the murder of Regina Martinez in 2012, a journalist and colleague of Espinosa at Proceso magazine. He covered the protests against the disappearance of the 43 students of Ayotzinapa by local police in Guerrero and acts of repression by the Veracruz state government.

Espinosa captured a front-page photo of Governor Duarte, big-bellied and wearing a police cap, which appeared on the cover of Proceso alongside the title: “Veracruz, a Lawless State.” Espinosa noted that the governor was so enraged by the photo he had his agents obtain and destroy as many copies of the magazine as they could get their hands on. He reported that while he was taking pictures of the eviction of protesters, a government agent told him, “You better stop taking pictures or you´ll end up like Regina.”

The Mexican Special Prosecutor’s Office for Crimes Against Freedom of Expression recognizes 102 journalists murdered from 2000 to 2014.

Yet the Mexico City prosecutor didn’t even mention the threats and attacks against Nadia Vera, an activist and a member of the student organization YoSoy132, as a line of investigation in her murder. The UN High Commission on Human Rights in Mexico stated that Vera and the other female victims found with Espinosa showed signs of sexual torture. Mexico City investigators announced that they were applying investigative protocols for possible femicides, but didn’t say why or confirm the reports of rape and sexual torture.

The invisibility of the women victims in the press and the official statements has been partially compensated for by social media. In social networks, millions of posts and tweets have brought to light the lives of the women, and especially Nadia’s more public and activist past, in an impromptu campaign that insists that women’s lives also matter.

Signs of a Cover-Up?

Now, just days into the investigation, with the nation — and especially journalists — reeling from the news, there are already signs of a cover-up.

On August 2, Mexico City Attorney General Rodolfo Rios gave a press conference reporting on advances in the case. Although Rios promised to pursue all lines of investigation, he downplayed the possibility that this could be a political crime against freedom of expression, claiming that Espinosa was not currently employed.

Rios also stated that the photojournalist came to Mexico City to look for work — a thinly veiled attempt to pre-empt the dead journalist’s own version of the facts that he was forced to leave Veracruz due to ongoing persecution. The city attorney’s office has put forth robbery as the principal motive of the crime, despite the execution-style torture and killings, and hasn’t called on anyone from the Veracruz government to provide testimony.

These are signs that the city government may be trying to railroad the investigation, and they’ve outraged the public, especially journalists. The attorney general’s absurd claim that Espinosa was unemployed at the time of his murder, seemingly suggesting that his journalistic work wasn’t a motive, caused particular indignation.

On August 5, investigators announced that they’d arrested and were questioning a suspect based on a match with a fingerprint found in the apartment. Despite apparent advances, there’s a growing fear that the government has no intention of really investigating a crime that could lead straight to a powerful member of the president’s own party.

The U.S. Role

The involvement of the Mexican government in the crime itself, or at least in creating the climate that led to the crime and failing to prevent it, raises serious questions for U.S. policymakers as well. The watchdog organization Article 19 reports that nearly half of the aggressions against journalists registered were carried out by state agents.

Since 2008, the U.S. government — through the Merida Initiative and other sources — has provided some $3 billion to the Mexican government for the war on drugs. This is a period when attacks on human rights defenders and journalists have skyrocketed, and more than 100,000 people have been killed by criminals and security forces alike.

A fraction of that money has gone to mechanisms for protection that have so far proved worthless. Rather than helping, this serves to support the false idea that the Mexican state is the good guy in a war on organized crime. The cases of corruption, complicity, and abuse that pile up week by week have demolished this premise.

Supporting abusive governments and security forces while claiming to support the journalists and human rights defenders being attacked by them is like pretending to help the fox while arming the hunter — it just prolongs the hunt. Mexican citizens who speak up are being hunted, too often by their own government. It’s time the U.S. government came to grips with that and immediately suspended the Merida Initiative.

Until there is accountability and justice — and an end to the murder of those who tell the truth about what’s happening here — sending U.S. taxpayer money to Mexican security forces is a vile betrayal of Mexicans’ friendship and of the highest principles of U.S. foreign policy.

On July 31, Espinosa was found beaten and shot dead in a Mexico City apartment.

Eight months ago, Nadia Vera, a student activist and cultural worker, looked boldly into a camera lens and told an interviewer that if anything happened to her, Veracruz governor Javier Duarte and his cabinet should be held responsible. She also fled Veracruz to the nation’s capital after suffering attacks.

On July 31, Nadia Vera was found sexually tortured and murdered, shot point-blank in the same apartment.

Three more women were assassinated in the normally tranquil, upper-middle class neighborhood that afternoon — an 18 year-old Mexican named Yesenia Quiroz, a Colombian identified only as “Nicole,” and a 40 year-old domestic worker named Alejandra. The press generally refers to the case as “the murder of Ruben Espinosa and four women,” relegating the women victims to anonymity even in death.

At a recent demonstration of journalists and human rights defenders, the sense of dread was palpable. As communicators in Mexico, we’re angry and intensely frustrated at how so many of our ranks have been killed, disappeared, displaced, or censored with no repercussions.

For many, including me, this crime especially hit home. For a long time, whenever I was asked if I was afraid to speak out critically in Mexico, I answered that fortunately Mexico City was relatively safe. Drug cartels and their allies in government only kept close tabs on reporters in more disputed areas.

The quintuple homicide in a quiet corner of the city shattered that myth — and with it what was left of our complacency. Several days before his murder, Espinosa told friends that a man had approached him to ask if he was the photographer who fled Veracruz. When he said yes, the man replied, “You should know that we’re here.”

Once considered a haven, Mexico City has become a hunting ground in a country where, too often, journalists end up reporting on the brutal assassinations of their colleagues — and wondering who will be next.

Targets

Ruben Espinosa had photographed social movements in the state of Veracruz for the past eight years, including journalists’ protests over the murder of Regina Martinez in 2012, a journalist and colleague of Espinosa at Proceso magazine. He covered the protests against the disappearance of the 43 students of Ayotzinapa by local police in Guerrero and acts of repression by the Veracruz state government.

Espinosa captured a front-page photo of Governor Duarte, big-bellied and wearing a police cap, which appeared on the cover of Proceso alongside the title: “Veracruz, a Lawless State.” Espinosa noted that the governor was so enraged by the photo he had his agents obtain and destroy as many copies of the magazine as they could get their hands on. He reported that while he was taking pictures of the eviction of protesters, a government agent told him, “You better stop taking pictures or you´ll end up like Regina.”

The Mexican Special Prosecutor’s Office for Crimes Against Freedom of Expression recognizes 102 journalists murdered from 2000 to 2014.

Yet the Mexico City prosecutor didn’t even mention the threats and attacks against Nadia Vera, an activist and a member of the student organization YoSoy132, as a line of investigation in her murder. The UN High Commission on Human Rights in Mexico stated that Vera and the other female victims found with Espinosa showed signs of sexual torture. Mexico City investigators announced that they were applying investigative protocols for possible femicides, but didn’t say why or confirm the reports of rape and sexual torture.

The invisibility of the women victims in the press and the official statements has been partially compensated for by social media. In social networks, millions of posts and tweets have brought to light the lives of the women, and especially Nadia’s more public and activist past, in an impromptu campaign that insists that women’s lives also matter.

Signs of a Cover-Up?

Now, just days into the investigation, with the nation — and especially journalists — reeling from the news, there are already signs of a cover-up.

On August 2, Mexico City Attorney General Rodolfo Rios gave a press conference reporting on advances in the case. Although Rios promised to pursue all lines of investigation, he downplayed the possibility that this could be a political crime against freedom of expression, claiming that Espinosa was not currently employed.

Rios also stated that the photojournalist came to Mexico City to look for work — a thinly veiled attempt to pre-empt the dead journalist’s own version of the facts that he was forced to leave Veracruz due to ongoing persecution. The city attorney’s office has put forth robbery as the principal motive of the crime, despite the execution-style torture and killings, and hasn’t called on anyone from the Veracruz government to provide testimony.

These are signs that the city government may be trying to railroad the investigation, and they’ve outraged the public, especially journalists. The attorney general’s absurd claim that Espinosa was unemployed at the time of his murder, seemingly suggesting that his journalistic work wasn’t a motive, caused particular indignation.

On August 5, investigators announced that they’d arrested and were questioning a suspect based on a match with a fingerprint found in the apartment. Despite apparent advances, there’s a growing fear that the government has no intention of really investigating a crime that could lead straight to a powerful member of the president’s own party.

The U.S. Role

The involvement of the Mexican government in the crime itself, or at least in creating the climate that led to the crime and failing to prevent it, raises serious questions for U.S. policymakers as well. The watchdog organization Article 19 reports that nearly half of the aggressions against journalists registered were carried out by state agents.

Since 2008, the U.S. government — through the Merida Initiative and other sources — has provided some $3 billion to the Mexican government for the war on drugs. This is a period when attacks on human rights defenders and journalists have skyrocketed, and more than 100,000 people have been killed by criminals and security forces alike.

A fraction of that money has gone to mechanisms for protection that have so far proved worthless. Rather than helping, this serves to support the false idea that the Mexican state is the good guy in a war on organized crime. The cases of corruption, complicity, and abuse that pile up week by week have demolished this premise.

Supporting abusive governments and security forces while claiming to support the journalists and human rights defenders being attacked by them is like pretending to help the fox while arming the hunter — it just prolongs the hunt. Mexican citizens who speak up are being hunted, too often by their own government. It’s time the U.S. government came to grips with that and immediately suspended the Merida Initiative.

Until there is accountability and justice — and an end to the murder of those who tell the truth about what’s happening here — sending U.S. taxpayer money to Mexican security forces is a vile betrayal of Mexicans’ friendship and of the highest principles of U.S. foreign policy.

http://www.businessinsider.com.au/hsbcs-money-laundering-scandal-by-the-numbers-2012-7

HSBC’s Money Laundering Scandal, By The Numbers

Photo: Andrew Burton/Getty Images)

This week a Senate investigation detailed that HSBC had lax controls against money-laundering and often ignored warnings about clients with ties to drug cartels and terrorists.The bank is also reportedly nearing a settlement with the Justice Department, which has two criminal investigations into whether HSBC was complicit in money-laundering and tax evasion.The federal regulator that should have been keeping tabs on all this, the Office of the Comptroller of the Currency, also came under fire for “systemic weaknesses” in its oversight of banks’ anti-money laundering procedures.

The report reaches back more than a decade, and in testimony in front of the Senate this week, the bank apologized and vowed it has recently overhauled its anti-money-laundering efforts. The bank’s head of compliance stepped down this week. But the Senate report notes that HBSC made similar promises of reform back in 2003 when it was cited by regulators for poor oversight of suspicious transactions. HSBC declined to comment further on the report or on the DOJ’s ongoing investigation.

There are lot of blunders and blind spots detailed in the Senate’s 335-page takedown. Here’s a rundown2014in each instance, we’ve linked to the relevant page in the report.

17,000: The backlog of unreviewed, potentially suspicious activity alerts at HSBC’s U.S. arm as uncovered by government regulators in 2010.

200: Number of compliance staff in bank’s U.S. branch between 2006 and 2009, of which a smaller group was charged with making sure the bank was following anti-money-laundering rules. HBUS had millions of accounts, and more than 16,000 employees overall, and according to the report, kept compliance staff small as a cost-cutting measure.Members of the anti-money-laundering group told investigators that understaffing was a key problem.

85: Number of problems with the anti-money-laundering efforts at bank’s U.S. arm red-flagged by the OCC between 2005 and 2010. That was a third more than the next-closest major bank.

0: number of enforcement actions the OCC took in that time period.

3: number of years, from 2006 to 2009, for which HSBC’s U.S. branch didn’t do any money-laundering monitoring for transactions with HSBC banks in other countries.

15 billion: Total value of U.S. dollar bills (as in paper money) the bank accepted as part of bulk-cash transactions from foreign HSBC banks during that period, with no anti money-laundering controls.

Concerns about HBMX, the bank’s Mexican arm

7 Billion: U.S. dollars exported from 2007-2008 from HBMX accounts to HSBC’s U.S. accounts. At the time, both American and Mexican officials raised concerns that such a volume was only possible if it included illegal drug money.

1: Rank of HBMX in repatriation of U.S. dollars from Mexico for those years. HBMX is only the 5th largest bank in Mexico.

50,000: Number of clients in 2008 with U.S. dollar accounts at an HBMX shell operation in the Cayman Islands.

75: Estimated percentage of those accounts for which HBMX had incomplete information on the account holder.

15: Estimated percentage of such accounts for which the bank had no account holder information. (In 2009, HBMX closed 9,000 Cayman U.S. dollar accounts, but continues to allow new ones to be opened there).

Potentially Violating Sanctions

28,000: Number of transactions by HSBC’s U.S. arm between 2001 and 2007 involving countries, groups, or individuals that the U.S. Treasury has sanctions against.

25,000: number of those transactions that involved Iran. The vast majority, auditors found, were sent through the U.S. without disclosing Iranian ties. In many cases, foreign HSBC banks substituted their own names for clients’ with Iranian ties to avoid triggering red flags.

300,000: dollar amount of a wire transfer that went through HBUS because a compliance officer didn’t realise “Persia” meant Iran.

2: transactions with Myanmar that slipped through filters because they didn’t recognise “Burmese” or “Mynmar.” [sic]

2: Number of U.S. dollar accounts established by HBSC’s European operation in the U.K. for the “Taliban.” HSBC’s U.S. operation was unable to tell Senate investigators whether they ever processed transactions for the account.

Other shady ties

1 billion: U.S. dollars bought from HSBC between 2006 and 2010 by Al Rajhi, a Saudi Arabian bank previously cut off because of ties to terrorism. An HSBC official fought against concerns from compliance employees, because of the revenue they brought to the bank.(He apologized in front of the Senate committee Tuesday).

290 million: Amount in U.S. dollar travellers’ checks cleared by HSBC’s U.S. operation for a Japanese bank over four years. The checks originated at a Russian bank and were brought in by 30 clients who all claimed to be in the used car business. Compliance officers raised concerns in 2005, but HSBC didn’t stop processing the checks until October 2008. (When questioned by the Senate committee, the Japanese bank could offer no explanation for why “the parties were using U.S. dollars to purchase used cars located in Japan or why [the bank] had so little information about the 30 clients carrying in U.S. dollars travellers checks totaling about $500,000-$600,000 each day.”)

2,000: number of U.S.-based HSBC accounts opened by “bearer-share” corporations2014where whoever physically holds the stock owns the corporation, so there’s virtually no record of who owns them.

1,670: number of those accounts in the bank’s Miami branch, holding $2.6 billion in assets. One such account was linked to a Miami real estate family convicted of tax fraud for hiding nearly $200 million through bearer-share accounts. Another account, for a Peruvian family, was opened without the normal controls on bearer-shares. One HSBC executive wrote in an email in support of waiving the requirements, “this is too important a family in Peru for us not to want to do business with.”

http://www.huffingtonpost.com/2015/02/09/hsbc-admission-swiss-banks_n_6646300.html

HSBC Admits Failings After Reports Reveal Subsidiary Helped Rich Hide Money

Posted: Updated:

* HSBC admits failings by Swiss subsidiary

* Leaked documents allege bank helped clients to evade taxes

* Allegations date back to 2006-07

* Clients include music and sports stars, royalty

* HSBC said Swiss business has since had "radical transformation" (Adds details of HSBC account holders)

By Steve Slater and Joshua Franklin

LONDON/ZURICH, Feb 9 (Reuters) - British bank HSBC Holdings Plc admitted failings by its Swiss subsidiary in response to media reports it helped wealthy customers dodge taxes and conceal millions of dollars of assets.

The International Consortium of Investigative Journalists (ICIJ), which coordinated the reporting, said a list of people who held HSBC accounts in Switzerland included soccer and tennis professionals, rock stars and Hollywood actors.

Reuters could not independently verify any of the names listed by the ICIJ. Having a Swiss bank account is not illegal and many are held for legitimate purposes.

The client list included royalty such as Morocco's King Mohammed, politicians, corporate executives including former Santander chairman Emilio Botin, who died last year, and wealthy families, the ICIJ said. A spokesman for the Moroccan royal palace declined to comment.

It also listed arms dealers, people linked to former dictators and traffickers in blood diamonds, and several individuals on the current U.S. sanctions list, including Gennady Timchenko, an associate of Russian President Vladimir Putin. Timchenko's Volga Group declined to comment.

"We acknowledge and are accountable for past compliance and control failures," HSBC said late on Sunday after news outlets published the allegations about its Swiss private bank.

The Guardian, along with other news outlets, cited documents obtained by the ICIJ via French newspaper Le Monde.

HSBC said that its Swiss arm had not been fully integrated into HSBC after its purchase in 1999, allowing "significantly lower" standards of compliance and due diligence to persist.

The Guardian asserted that the files showed HSBC's Swiss bank routinely allowed clients to withdraw "bricks" of cash, often in foreign currencies which were of little use in Switzerland.

HSBC also marketed schemes which were likely to enable wealthy clients to avoid European taxes and colluded with some to conceal undeclared accounts from domestic tax authorities, the Guardian added.

The reports triggered political debate in Britain ahead of a parliamentary election in May. Margaret Hodge, a senior opposition Labor Party lawmaker, said UK tax authorities had done too little.

"All the other countries have collected much more," she told BBC Radio on Monday. "We are never assertive enough, aggressive enough to protect the taxpayer."

David Gauke, a Conservative lawmaker and a junior minister in the finance ministry, criticized HSBC and said the case lifted the lid on poor banking behavior at the time.

"Clearly HSBC have got questions to answer. Clearly the behavior that is set out in these disclosures reveal behavior in 2005 to 2007 that is not what we would expect from a major bank," he said, calling tax evasion "completely unacceptable."

John Mann, a Labor politician, said HSBC and UK revenue office bosses should be called before lawmakers.

The HSBC client data were supplied by Herve Falciani, a former IT employee of HSBC's Swiss private bank, HSBC said. HSBC said Falciani downloaded details of accounts and clients at the end of 2006 and early 2007. French authorities have obtained data on thousands of the customers and shared them with tax authorities elsewhere, including Argentina.

Switzerland has charged Falciani with industrial espionage and breaching the country's secrecy laws. Falciani could not be reached for comment on Monday but has previously told Reuters he is a whistleblower trying to help governments track down citizens who used Swiss accounts to evade tax.

FOUR-PAGE RESPONSE